maryland student loan tax credit 2020

File Maryland State Income Taxes for the 2019 year. To qualify for the Student Loan Debt Relief Tax Credit you must.

Marylanders Urged To Apply For Student Loan Debt Relief Tax Credit 47abc

February 18 2020 842 AM.

. The Student Loan Debt Relief Tax Credit may be claimed on Form 502CR by certain qualified taxpayers in the amount certified by the Maryland Higher Education Commission. ANNAPOLIS MDGovernor Larry Hogan and Maryland Higher Education. Maryland Student Loan Tax Credit 2020.

The scholar Loan debt settlement Tax Credit is an application created under В 10-740 associated with Tax-General Article of this Annotated Code of Maryland to give earnings. The Homestead Credit limits the increase. The total amount of the credit claimed shall be recaptured if you dont use the credit for the repayment of the undergraduate student loan debt within 2 years.

Governor Hogan Announces 2019 Award of 9 Million in Tax Credits for Student Loan Debt. The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes. The Student Loan Debt Relief Tax Credit may be claimed on Form 502CR by certain qualified taxpayers in the amount certified by the Maryland Higher Education Commission.

Student Loan Debt Relief Tax Credit for Tax Year 2020. Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan debt and have at least 5000 in outstanding student loan debt. Incurred at least 20000 in.

The tax credit is claimed on your Maryland income tax return when you file your Maryland taxes. Maryland student loan debt relief tax credit program more than 9k marylanders will receive student loan tax credit. If the credit is more than the taxes you would otherwise owe you will receive a.

Tax Year 2020 Only. This application and the related instructions are for Maryland residents. The Maryland Higher Education Commissionmay request additional.

Instructions are at the end of this application. Student Loan Debt Relief Tax Credit Application for Maryland Residents Maryland Part-year Residents. To anyone who applied for the MHEC student loan debt relief tax credit for 2020 you may want to check your applicationaward status on the Maryland OneStop portal to see if you were.

2020 Maryland Statutes Tax - General Title 10 - Income Tax Subtitle 7 - Income Tax Credits Section 10-740 - Student Loan Debt Relief Tax Credit. To help homeowners deal with large assessment increases on their principal residence state law has established the Homestead Property Tax Credit. Indicate if you have applied for a Maryland.

Were eligible for in-state tuition. If the credit is more than the taxes you would otherwise owe you will receive a. There were 5145 applicants who attended in-state institutions and will each receive 1067 in tax credits while 4010 eligible applicants attended out-of-state institutions.

Will have maintained residency within the state of Maryland for the 2020 tax year Have incurred 20000 or more in. Additional prioritization criteria are set forth in 10-740 of the Tax-General Article of the Annotated Code of Maryland and in the implementing regulations.

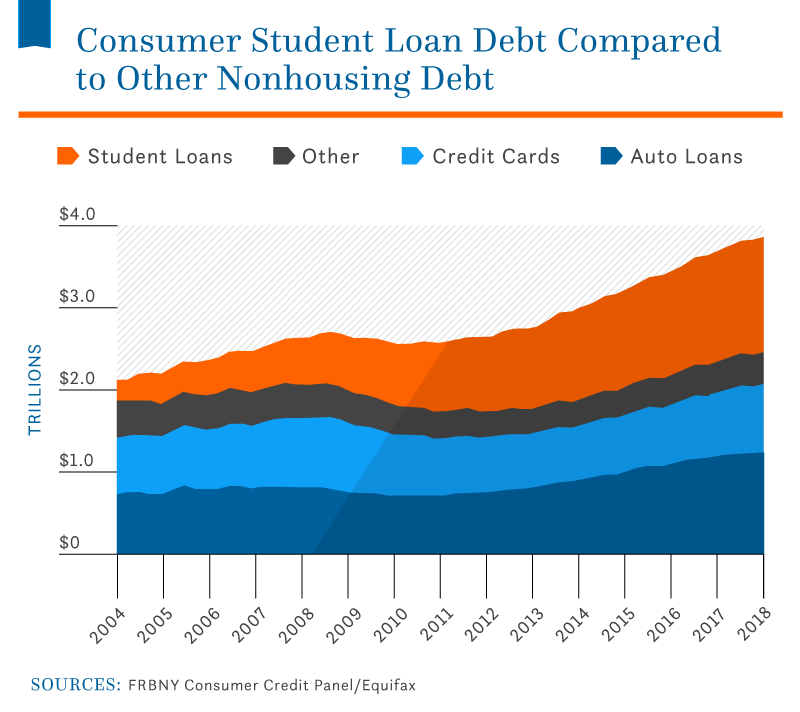

Student Loan Debt 2022 Facts Statistics Nitro

More Companies Are Helping Workers Pay Down Student Loans Money

A Simple Tool Has Brought Health Insurance To Thousands The Pew Charitable Trusts

Chart Where U S Student Debt Is Highest Lowest Statista

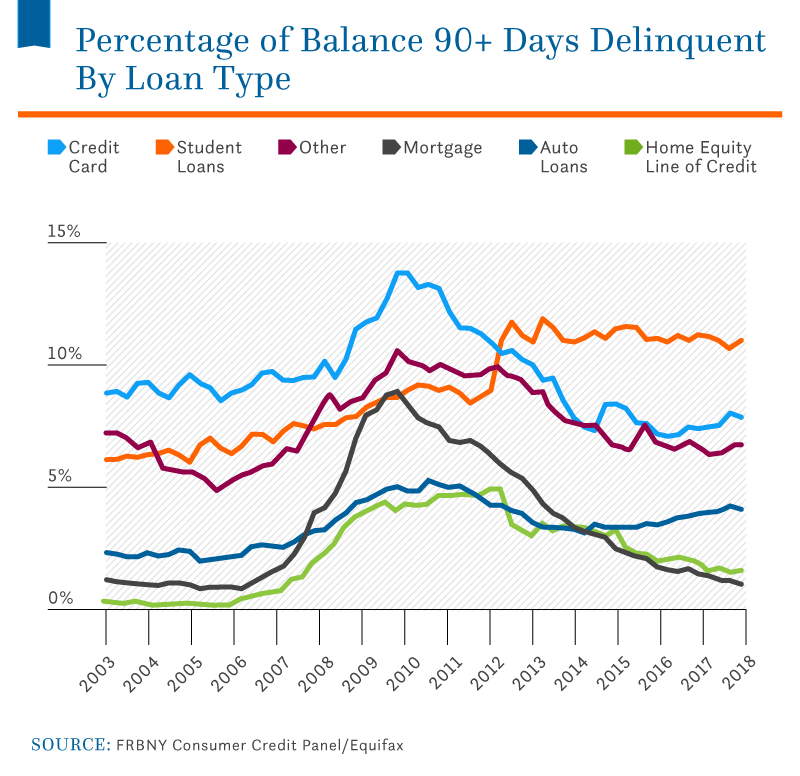

How Student Debt Became A 1 6 Trillion Crisis

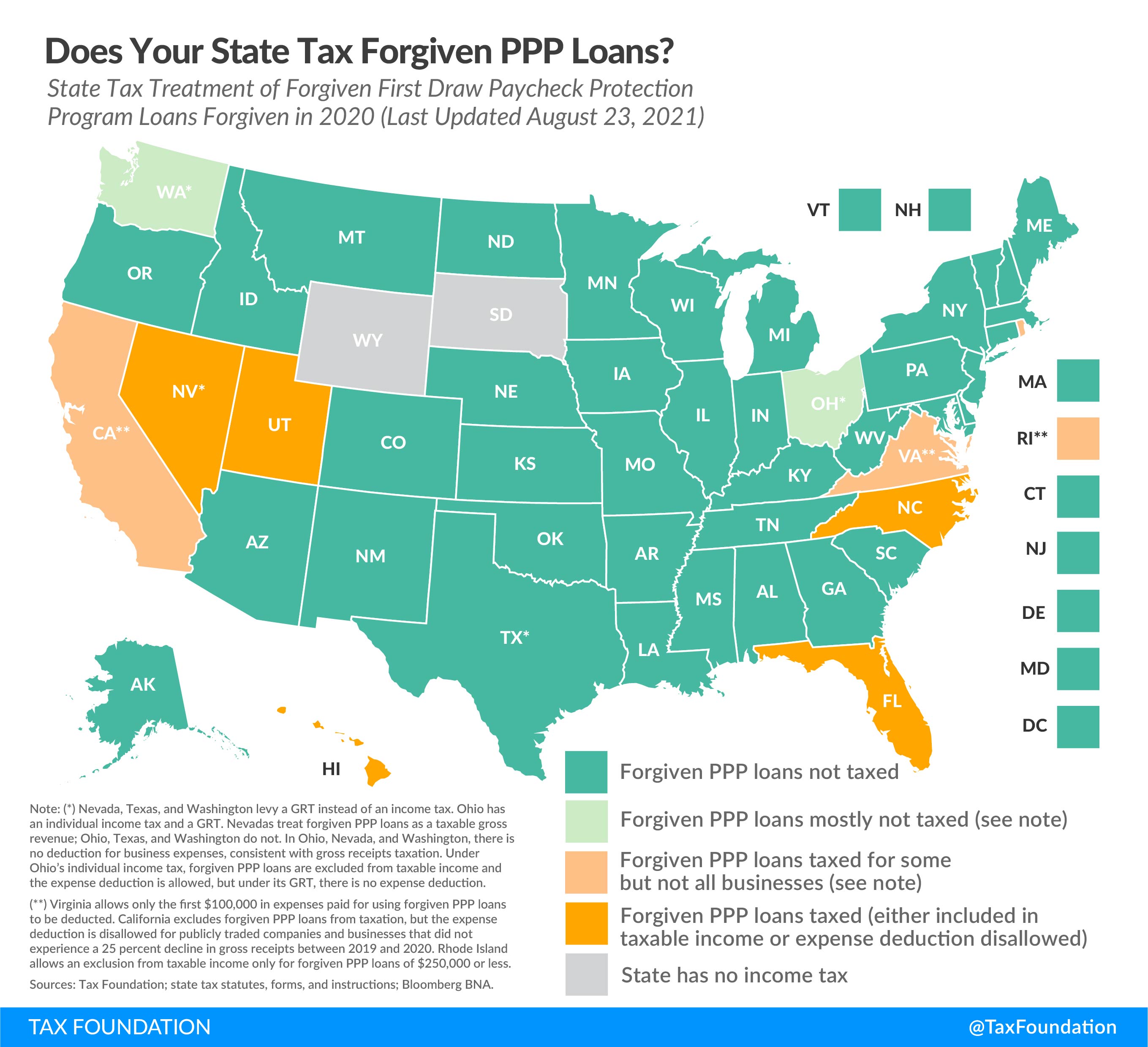

Ppp Loan Forgiveness Which States Are Taxing Forgiven Ppp Loans

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition And Filing

What Student Loan Tax Credit Can I Claim Frank Financial Aid

Maryland Tax Rates Rankings Maryland State Taxes Tax Foundation

Student Loan Debt 2022 Facts Statistics Nitro

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Income Recertification Planning As Student Loan Freezes Ends

Can The Student Loan Interest Deduction Help You Citizens

Is Student Loan Interest Tax Deductible Rapidtax

Is Student Loan Forgiveness Taxable It Depends Conduit Street

Student Loan Debt Today Empower